“The macroeconomic conditions that underpin our oil demand projections deteriorated over the past month as trade tensions escalated between the United States and several other countries,” a March oil market report from the International Energy Agency (IEA) notes, highlighting the downside risks of US tariffs and retaliatory measures.

The instability and weaker-than-expected consumption from advanced and developing economies prompted the IEA to downgrade its growth estimates for Q4 2024 and Q1 2025 to about 1.2 million barrels per day.

Despite the uncertain outlook, an announcement that OPEC+ would extend a 2.2 million barrel per day production cut into Q2 added some support to the market amid global growth concerns and rising output in the US.

Prices spiked at the end of March, pushing both benchmarks to within a dollar of their 2025 start values. However, the rally was short-lived and prices had plummeted by April 9.

Oil prices fall as OPEC hikes output and supply risks mount

WTI price performance, December 31, 2024, to April 23, 2025.

Chart via the Investing News Network.

Sinking to four year lows, Brent and WTI fell below the critical US$60 per barrel threshold, to US$58.62 (Brent) and US$55.38 (WTI), lows not seen since April 2021. The decline saw prices shed more than 21 percent between January and April shaking the market and investor confidence.

“We’re into the supply destruction territories for some of the high cost producers,” Ole Hansen, head of commodity strategy at Saxo Bank, told the Investing News Network. “It will not play out today or tomorrow, because a lot of these producers are forward hedging as part of their production.”

Watch Hansen discuss where oil and other commodities are heading.

According to Hansen, if prices remain in the high US$50 range US production will likely decrease, aiding in a broader market realignment. “Eventually we will see production start to slow in the US, probably other places as well, and that will help balance the market,” the expert explained in the interview. “Helping to offset some of the risk related to recession, but also some of the production increases that we’re seeing from OPEC.”

In early April, OPEC+ did an about face when it announced plans for a significant increase in oil production, marking its first output hike since 2022. The group plans to add 411,000 barrels per day (bpd) to the market starting in May, effectively accelerating its previously gradual supply increase strategy.

Although the group cited “supporting market stability” as the reasoning behind the increase, some analysts believe the decision is a punitive one targeted at countries like Iraq and Kazakhstan who consistently exceed production quotas.

“(The increase) is basically in order to punish some of the over producers,” said Hansen. He went on to explain that Kazakhstan produced 400,000 barrels beyond its quota.

If these countries return to their agreed limits, it could offset OPEC’s planned production hikes.

At the same time, US sanctions on Iran and Venezuela may tighten global supply further, while a growing military presence in the Middle East also signals rising geopolitical risks, particularly involving Iran.

Oil price forecast for 2025

As such Hansen expects prices to fluctuate between US$60 to US$80 for the rest of the year.

“(I am) struggling to see, prices collapse much further than that, simply because it will have a counterproductive impact on supply and that will eventually help stabilize prices,” said Hansen.

Hansen’s projections also fall inline with data from the US Energy Information Administration (EIA). The organization downgraded the US$74 Brent price forecast it set in March to US$68 in April.

The EIA foresees US and global oil production to continue rising in 2025, as OPEC+ speeds up its planned output increases and US energy remains exempt from new tariffs.

Starting mid-year, global oil inventories are projected to build. However, the EIA warns that economic uncertainty could dampen demand growth for petroleum products, potentially falling short of earlier forecasts.

“The combination of growing supply and lower demand leads EIA to expect the Brent crude oil price to average less than US$70 per barrel in 2025 and fall to an average of just over US$60 per barrel in 2026,” the April report read.

Supply concerns add tailwinds for natural gas

On the natural gas side, Q1 was marked by tight conditions amid rising demand. A colder-than-normal winter led to increased consumption, with US natural gas withdrawals in Q1 exceeding the five-year average.

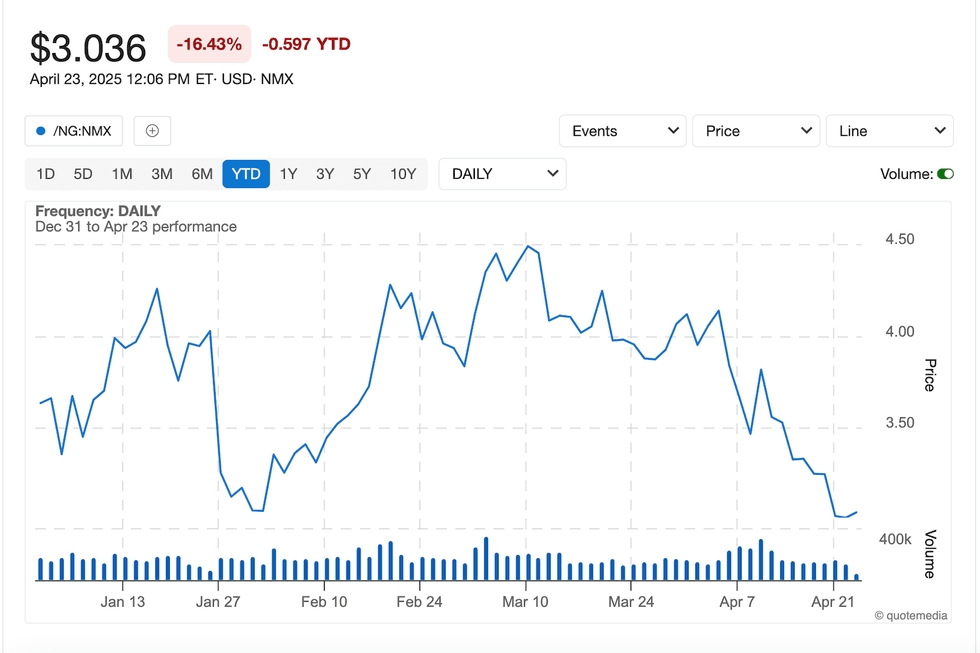

Starting the year at US$3.59 per metric million British thermal units, prices rose to a year-to-date high of US$4.51 on March 10. Values pulled back by the end of the 90 day period to the US$4.09 level, registering a 13.9 percent increase for Q1.

“Cold weather during January and February led to increased natural gas consumption and large natural gas withdrawals from inventories,” a March report from the EIA explains.

Natural gas price performance, December 31, 2024, to April 23, 2025.

Chart via the Investing News Network.

“(The) EIA now expects natural gas inventories to fall below 1.7 trillion cubic feet at the end of March, which is 10 percent below the previous five-year average and 6 percent less natural gas in storage for that time of year than EIA had expected last month,” the document continues.

Natural gas price forecast for 2025

Following record setting demand growth in 2024 the gas market is expected to remain tight through 2025, amid market expansion from Asian countries.

The IEA also pointed to price volatility brought on geopolitical tensions as a factor that could move markets.

“Though the halt of Russian piped gas transit via Ukraine on 1 January 2025 does not pose an imminent supply security risk for the European Union, it could increase LNG import requirements and tighten market fundamentals in 2025,” the organization notes in a gas market report for Q1.

Although the market is forecasted to remain tight the IEA expects growth in global gas demand to slow to below 2 percent in 2025. Similarly to 2024’s trajectory, growth is set to be largely driven by Asia, which is expected to account for almost 45 percent of incremental gas demand, the report read.

THe US-based EIA has a more optimistic outlook for the domestic gas sector, projecting the annual demand growth rate to be 4 percent for 2025.

“This increase is led by an 18 percent increase in exports and a 9 percent increase in residential and commercial consumption for space heating,” an April EIA market overview states.

The report attributes the expected export growth to increased liquefied natural gas (LNG) shipments out of two new LNG export facilities, Plaquemines Phase 1 and Golden Pass LNG.

Venture Global’s (NYSE:VG) Plaquemines LNG facility in Louisiana commenced production in December 2024 and is currently in the commissioning phase.

Once fully operational, it is expected to have a capacity of 20 million metric tons per annum. The facility has entered into binding long-term sales agreements for its full capacity

Golden Pass LNG, a joint venture between ExxonMobil (NYSE:XOM) and state-owned QatarEnergy, is under construction in Sabine Pass, Texas. The project has faced delays due to the bankruptcy of a key contractor, with Train 1 now expected to be operational by late 2025 . Upon completion, Golden Pass LNG will have an export capacity of up to 18.1 million metric tons per annum.

The EIA forecasts natural gas prices to average US$4.30 in 2025, a US$2.10 increase from 2025. Farther ahead the EIA has a more modest forecast of US$4.60 for 2026.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web