The stock market’s momentum from earlier this week, which saw the S&P 500 (INDEXSP:.INX) and the Nasdaq Composite (INDEXNASDAQ:.IXIC) reach new record highs, came to a halt on Friday (August 1).

Investors were reacting to a series of mixed tech earnings reports. Many were accompanied by cautious forward-looking guidance despite strong top-line numbers. This sentiment was further soured by fresh economic data out of the US showing that while employment remains strong, there are signs inflation is reaccelerating.

The most significant blow, however, came from geopolitical developments that reignited global trade tensions, prompting new fears of retaliatory tariffs and the potential for a renewed surge in inflation.

1. Samsung and Tesla strike deal

Tesla (NASDAQ:TSLA) CEO Elon Musk announced a US$16.5 billion deal with Samsung Electronics (HKEX:2814) that would see the electronics conglomerate produce AI6 semiconductors for the carmaker until 2033.

Production will take place at Samsung’s new fab in Taylor, Texas. The news led to a 6.8 percent rise in Samsung’s shares on Monday (July 28), as well as a 1 percent increase for Tesla. Last week, the carmaker saw its share price decline after reporting a 12 percent drop in revenue, marking its biggest quarterly decline in over 10 years.

Musk called the deal’s strategic importance “hard to overstate” in a post on X. “Samsung agreed to allow Tesla to assist in maximizing manufacturing efficiency. This is a critical point, as I will walk the line personally to accelerate the pace of progress. And the fab is conveniently located not far from my house,” Musk added in another post.

“The $16.5B number is just the bare minimum,” he also said. “Actual output is likely to be several times higher.”

2. Bell Canada and Cohere partner on sovereign AI

BCE (TSX:BCE,NYSE:BCE) and Canadian artificial intelligence (AI) company Cohere announced a partnership on Monday that will see them work together to provide AI services to Canadian companies and government agencies.

The deal is focused on sovereign AI, meaning all data will stay within Canada.

“At a critical time for Canada, we’re proud to partner with Cohere to create a sovereign, full-stack AI solution, custom-built to support the Canadian government and business. Working together, we will both transform Canadian businesses through cutting-edge AI capabilities, while ensuring that the data remains secure and within Canada,” said Mirko Bibic, president and CEO of BCE, previously known as Bell Canada Enterprises.

“Our partnership with Bell Canada will provide the Canadian government and enterprises with world-class options for sovereign, security-first AI,” added Aidan Gomez, co-founder and CEO of privately owned Cohere.

This has the potential to be truly transformative for organizations looking to massively increase their productivity and efficiency without any compromise on data security and privacy.”

Under the terms of the deal, Bell will provide the physical infrastructure, including its national network and data centers. Meanwhile, Cohere will provide its powerful AI models to offer a secure, all-in-one AI solution. This helps Canadian organizations adopt new technology. It also ensures their sensitive information is kept safe at home.

3. Palo Alto Networks to acquire CyberArk

On Wednesday (July 30), Palo Alto Networks (NASDAQ:PANW) announced plans to acquire Israeli AI cybersecurity firm CyberArk Software. The Wall Street Journal had reported on Tuesday (July 29) that they were in talks.

Under the terms of the agreement, CyberArk shareholders will receive US$45 cash and 2.2005 shares of Palo Alto per share of CyberArk. Palo Alto expects the transaction to be immediately accretive to its revenue growth and gross margin, and accretive to free cash flow per share in fiscal year 2028.

In a press release announcing the acquisition, Nikesh Arora, chairman and CEO of Palo Alto, said:

“Our market entry strategy has always been to enter categories at their inflection point, and we believe that moment for Identity Security is now. This strategy has guided our evolution from a next-gen firewall company into a multi-platform cybersecurity leader. Today, the rise of AI and the explosion of machine identities have made it clear that the future of security must be built on the vision that every identity requires the right level of privilege controls, not the ‘IAM fallacy’. CyberArk is the definitive leader in Identity Security with durable, foundational technology that is essential for securing the AI era. Together, we will define the next chapter of cybersecurity.”

Udi Mokady, founder and executive chairman of CyberArk, called the news a “profound moment in CyberArk’s journey,” saying that they combination will accelerate the mission it began more than two decades ago.

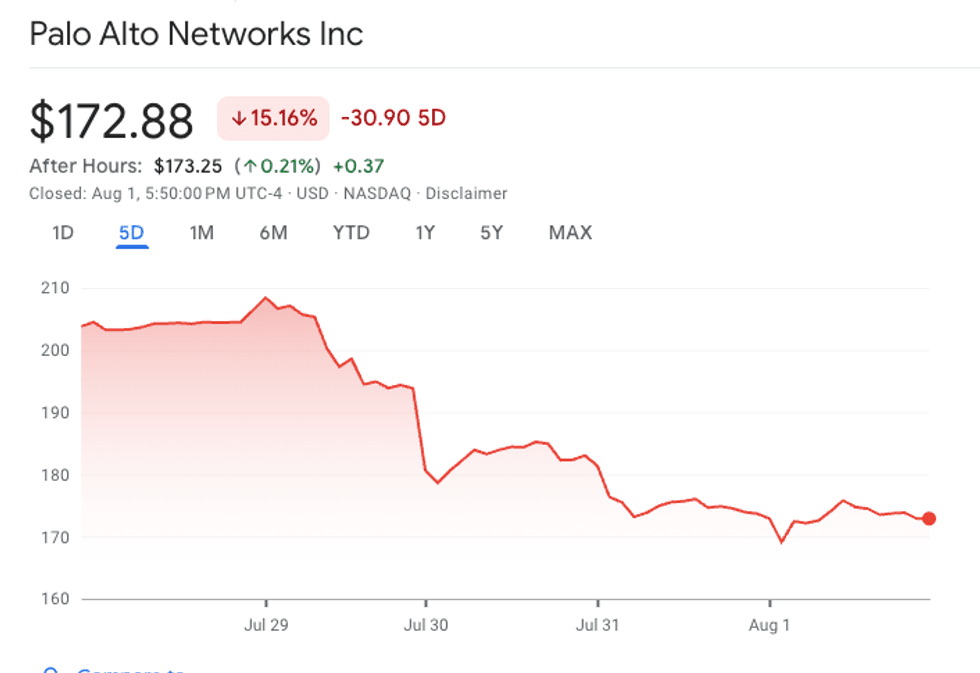

Palo Alto Networks performance, July 29 to August 1, 2025.

Chart via Google Finance.

The deal is expected to close in the second half of Palo Alto’s 2026 fiscal year, subject to regulatory and CyberArk shareholder approval. Although Palo Alto hit a high of US$210.39 on Tuesday, shares of the company declined by 5 percent following the announcement and closed 17.83 percent below Tuesday’s high.

4. Microsoft, Meta, Amazon and Apple report quarterly results

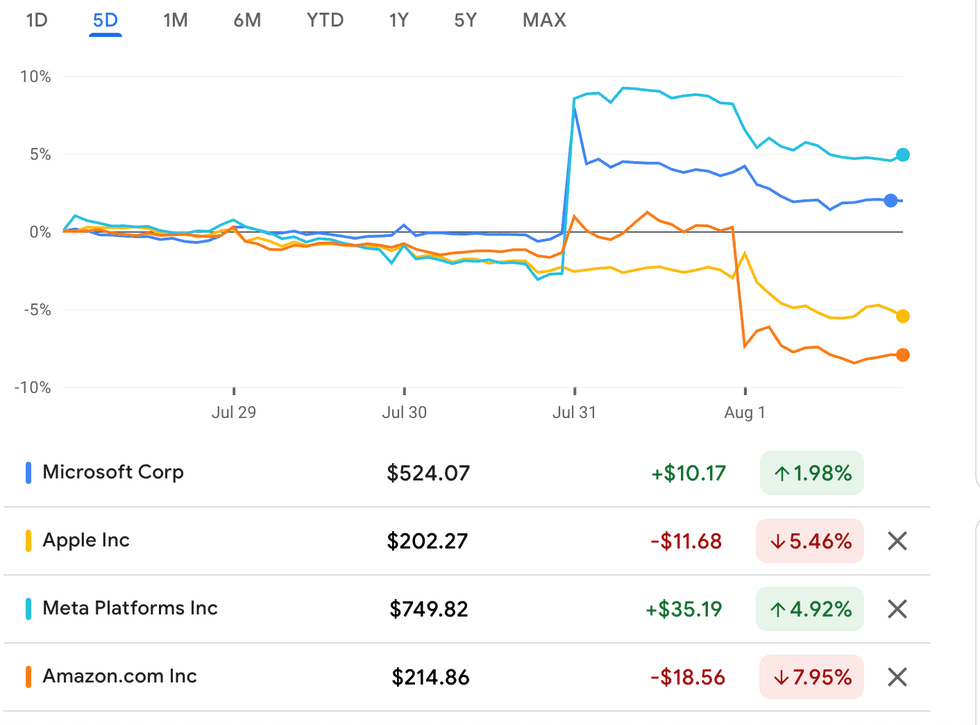

Microsoft (NASDAQ:MSFT) ended its fourth fiscal quarter of 2025 with record revenue, driven by strong AI and cloud service growth. Microsoft Cloud revenue exceeded US$168 billion, a 23 percent increase, and Intelligent Cloud, including Azure, grew 26 percent to US$29.9 billion, with Azure up 39 percent. Although significant AI investments (over 100 million monthly Copilot users) caused a slight gross margin dip, the firm’s operating income rose 23 percent.

CEO Satya Nadella expressed confidence in long-term growth. For her part, CFO Amy Hood noted that commercial bookings surpassed US$100 billion; she anticipates double-digit revenue and operating income growth in the 2026 fiscal year, though data center capacity may remain constrained through the first half of the period.

Meta Platforms (NASDAQ:META) also had a positive Q2, with revenue up 22 percent to US$47.52 billion and net income up 36 percent to US$18.34 billion. Earnings per share rose 38 percent to US$7.14.

CEO Mark Zuckerberg highlighted the company’s focus on “personal superintelligence.”

The Family of Apps saw daily active people increase 6 percent to 3.48 billion, and advertising revenue grew with impressions up 11 percent and average price per ad up 9 percent.

Q3 revenue is projected to be US$47.5 billion to US$50.5 billion. However, regulatory challenges in the EU could impact European revenue. Meta is also heavily investing in AI and infrastructure, with 2025 capital expenditures narrowed to US$66 billion to US$72 billion, and similar growth expected in 2026.

Microsoft, Apple, Meta Platforms and Amazon performance, July 29 to August 1, 2025.

Chart via Google Finance.

Amazon (NASDAQ:AMZN) delivered a strong second quarter, with overall net sales growing 13 percent year-on-year to $167.7 billion. The company’s net income also saw a significant increase, rising 35 percent year-on-year to $18.16 billion.

The growth was fueled by strong performance across all three of its major segments. The North America segment, which accounted for 60 percent of total net sales, saw a revenue increase of 11 percent year-on-year to $100.07 billion.

The International segment saw its net sales grow by 16 percent year-on-year to $36.76 billion, with a particularly notable 448 percent increase in operating income. Amazon Web Services continued its steady performance, with net sales reaching $30.87 billion, up 17 percent year-on-year. Despite its strong revenue growth, the company’s trailing 12 month free cashflow declined by 66 percent year-on-year to $18.18 billion.

Finally, Apple (NASDAQ:AAPL) posted strong results for its third fiscal quarter of 2025, with total net sales increasing to US$94.04 billion, up from US$85.78 billion in the same quarter last year.

The company’s net income rose to US$23.43 billion, an increase from US$21.45 billion year-on-year. This performance translated to earnings per share of US$1.57, up from US$1.40 in the prior year. The growth was primarily driven by its products and services, with the iPhone and Mac categories seeing notable increases in net sales. Apple’s services segment also continued its expansion, with sales rising to US$27.42 billion from US$24.21 billion a year ago.

5. Figma makes public debut

Figma’s highly anticipated initial public offering (IPO) generated significant buzz this week, with its share price and valuation surging dramatically on its first day of trading.

On Monday, Figma increased its IPO price range to US$30 to US$32 a share, up from US$25 to US$28. This new pricing valued the company at up to a US$18.7 billion market cap and a US$17.2 billion enterprise value. According to Bloomberg, people familiar with the matter indicated that the IPO was approaching 40 times oversubscribed.

The company had its first day of trading on the NYSE on Thursday (July 31).

Figma’s shares surged by 250 percent from US$33 to US$115 following a blockbuster IPO, with the company raising US$1.22 billion. Its market cap reached US$67 billion by the end of the market’s close. On Friday, Figma opened at US$134.82 before pulling back alongside other major tech stocks and risk assets to finish the week at US$122. Its debut surge and end-of-day valuation made it one of the largest and most successful tech IPOs in recent memory.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.