Canada’s high

cost of living

is eroding the confidence of its residents when it comes to their

retirement plans.

Two-thirds of Canadians say inflation has made it difficult to save for retirement, while 74 per cent said high prices have added to the concerns that their retirement nest egg may not be enough, according to a

by Bank of Montreal.

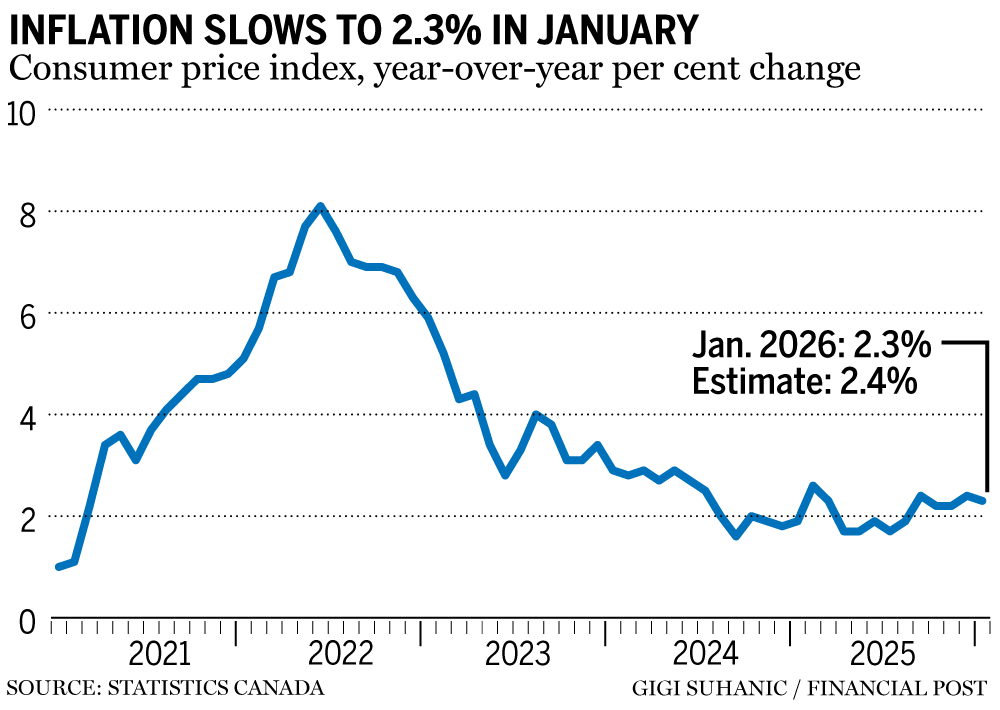

Canada’s

inflation rate inched lower to 2.3 per cent

in January, but a 16.7 per cent drop in gas prices was the main factor behind the dip. Without gas prices, inflation was three per cent, right on the upper limit of the Bank of Canada’s target range.

Among those who said inflation is hurting their savings prospects, about half said they are paying between $100 and $300 more per month for necessities, while a third said it’s costing them more than $300 extra.

Canadians are trying to make up the difference, with 31 per cent saying they are contributing less to retirement, 27 per cent are cutting back on spending and 17 per cent are pausing retirement savings altogether.

As a result, they may be falling behind on retirement savings. Canadians are earmarking about 3.74 per cent of their disposable income for retirement, amounting to about $3,570 per year, according to a

report by Fidelity Investments Canada ULC

.

Fidelity said Canadians under the age of 35 have median household savings of $159,100, which grows to $738,900 for those 65 years of age or older.

But BMO said Canadians are worried about their money lasting. While 30 per cent said they don’t know how long their savings might last, 22 per cent said they would last between 10 and 20 years and just 13 per cent believe they will last more than 30 years.

BMO recommends retirement savers start planning early, maintain savings plans as part of their regular expenses and seek professional advice to recommend new saving strategies.

“The key is to stay invested and take a proactive approach,” Brent Joyce, chief investment strategist at BMO Private Wealth, said in a release. “By incorporating inflation assumptions into comprehensive financial plans, we help Canadians understand how their portfolios can perform over decades — not just years. With disciplined investing and expert guidance, clients can ensure their money grows faster than inflation and supports the lifestyle they’ve envisioned.”

Sign up here to get Posthaste delivered straight to your inbox.

Canada’s inflation rate slowed to 2.3 per cent year-over-year in January, as a steep drop in gasoline prices moved the overall rate down.

In total, gas prices dropped 16.7 per cent in the month, meaning inflation without gas actually ticked up to three per cent.

The GST/HST holiday in early 2025 meant that restaurant prices climbed 12.3 per cent last month, while other products covered under the program, including toys, clothing and alcohol, also rose.

The figures have some economists suggesting that the door may be opening for the

Bank of Canada

to cut interest rates once again.

Read more here.

- 2:00 p.m.: U.S. Federal Open Market Committee minutes

- Today’s Data: Canada existing home sales and MLS home price index for December, U.S. housing starts for November and December

- Earnings: HSBC Holdings Plc, Rin Tonto Plc, DoorDash Inc., Kinross Gold Corp., Nutrien Ltd., Molson Coors Beverage Co.

- Cooler inflation gives Bank of Canada an opening to cut rates if economy falters, say economists

- Taxing unrealized gains is a silly idea that Canada should ignore

- Canada’s inflation rate cools to 2.3% as gas prices fall

- Ontario designates Kinross Gold’s Great Bear project for speedy permit approval

- Emmanuelle Gattuso has a radical idea: take names off buildings when the price is right

For those scared of running out of money in retirement, a quick assessment from a financial planner can go a long way to inspire confidence or make sure you are on the right track. These meetings can also help with understanding all your investments and where to go from there.

Read more here.

Interested in energy? The subscriber-only FP West: Energy Insider newsletter brings you exclusive reporting and in-depth analysis on one of the country’s most important sectors.

Sign up here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here